Best CRM for Financial Services: Choosing the Right Solution for Your Needs

Best CRM for Financial Services: In the fast-paced world of finance, having the right CRM system can make all the difference. From enhancing customer relationships to streamlining operations, the right CRM solution is crucial for success.

When it comes to navigating the complex landscape of financial services, finding the best CRM software tailored to your specific needs is essential. Let’s explore the key considerations and features that can help you make an informed decision.

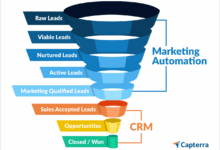

Introduction to CRM for Financial Services

In the realm of financial services, Customer Relationship Management (CRM) plays a crucial role in managing interactions with both current and potential customers. CRM in financial services involves strategies, technologies, and practices aimed at enhancing customer satisfaction, retention, and overall business growth.

Implementation of CRM Systems

Implementing a CRM system in a financial services company requires careful planning and execution to ensure seamless integration and optimal functionality. It involves assessing the organization’s needs, selecting the right CRM software, training employees, and continuously monitoring and updating the system.

- Popular CRM software used in financial institutions include Salesforce, Microsoft Dynamics 365, and Oracle CRM.

- Customizing a CRM system for a financial organization involves tailoring features such as lead management, contact management, and reporting to align with the specific requirements and workflows of the institution.

Data Management in CRM

Data management is a critical component of CRM for financial services, as it involves collecting, analyzing, and utilizing customer information to enhance relationships and drive business decisions. It ensures that accurate and relevant data is accessible to improve customer interactions and personalize services.

- Customer data typically collected and analyzed in CRM systems include contact details, transaction history, preferences, and behavior patterns.

- Maintaining data accuracy and privacy within a CRM framework requires implementing data quality controls, regular updates, and adherence to data protection regulations.

Customer Segmentation and Targeting

Customer segmentation and targeting within financial services CRM involve categorizing customers based on factors such as demographics, financial behavior, and preferences to deliver personalized experiences and offerings. It allows financial institutions to tailor their services to meet the specific needs of different customer segments.

- Segmenting customers based on their financial behavior and preferences enables institutions to create targeted marketing campaigns, product recommendations, and loyalty programs.

- Effective targeting of different customer segments involves analyzing data insights, predicting customer needs, and delivering relevant and timely communications to enhance engagement and satisfaction.

Compliance and Security in CRM

Ensuring compliance and security in CRM for financial services is imperative to protect sensitive customer information, uphold regulatory standards, and maintain trust with clients. Financial institutions must adhere to data protection laws, industry regulations, and internal security protocols to safeguard customer data.

- Regulatory compliance requirements for CRM systems in financial services include GDPR, HIPAA, PCI DSS, and other industry-specific regulations.

- Implementing data security measures such as encryption, access controls, and regular security audits helps mitigate risks and prevent data breaches in CRM environments.

Features to Look for in a CRM for Financial Services

When choosing a CRM system for financial services, it is crucial to consider specific features that cater to the unique needs of the industry. Here are some essential features to look for:

Lead Management

Lead management is a critical feature for financial services CRM as it helps track and prioritize potential clients. A good CRM system should allow for easy lead capture, qualification, and nurturing to convert leads into customers effectively.

Contact Management

Contact management is another crucial aspect to consider. The CRM should provide a centralized database to store and manage client information, interactions, and communication history. This feature enables financial professionals to have a 360-degree view of their clients and deliver personalized services.

Reporting Capabilities

A robust reporting system is essential for financial services CRM to analyze performance, track key metrics, and make data-driven decisions. The CRM should offer customizable reports and dashboards to monitor sales, marketing campaigns, and overall business performance.

Customization and Integration

Customization options are vital to tailor the CRM system to specific business needs and workflows. Additionally, integration with other tools like accounting software, email platforms, and financial planning tools enhances efficiency and streamlines processes.

Security and Compliance

Security and compliance are paramount in the financial services industry. The CRM system should have robust security measures to protect sensitive client data and ensure compliance with industry regulations such as GDPR, HIPAA, or SEC requirements.

Overall, selecting a CRM system with these features will help financial services professionals enhance client relationships, streamline operations, and drive business growth.

Popular CRM Solutions for Financial Services

When it comes to CRM solutions for financial services, there are several popular platforms that stand out, including Salesforce, HubSpot, and Microsoft Dynamics. Each of these CRM systems offers unique features and capabilities tailored to the specific needs of financial institutions.

Customization Options for Financial Service Companies

Customization is key when it comes to CRM solutions for financial service companies. Let’s compare and contrast the customization options offered by Salesforce, HubSpot, and Microsoft Dynamics:

- Salesforce: Known for its robust customization capabilities, Salesforce allows financial institutions to tailor their CRM system to meet their specific requirements. From creating custom fields to developing unique workflows, Salesforce offers a high level of flexibility.

- HubSpot: While HubSpot may not offer the same level of customization as Salesforce, it provides a user-friendly interface that allows for easy customization of contact records, deals, and pipelines. Financial service companies can still personalize their CRM experience with HubSpot.

- Microsoft Dynamics: Microsoft Dynamics offers a balance between customization and ease of use. It allows financial institutions to customize entities, fields, and relationships, providing a tailored CRM experience without the complexity of Salesforce.

Specific Needs and Regulatory Requirements

Each CRM system caters to the specific needs and regulatory requirements of the financial services industry in different ways:

- Salesforce: With industry-specific solutions and compliance tools, Salesforce helps financial institutions ensure regulatory compliance and data security. It offers features like encryption, audit trails, and role-based access control.

- HubSpot: HubSpot focuses on marketing automation and lead management, helping financial service companies streamline their marketing efforts while adhering to industry regulations. It also offers tools for email compliance and GDPR readiness.

- Microsoft Dynamics: Microsoft Dynamics emphasizes seamless integration with Microsoft Office and other business applications, making it easier for financial institutions to manage customer relationships while staying compliant with regulations.

Comparison Table

| CRM Platform | Pricing | Integration Capabilities | Industry-Specific Features |

|---|---|---|---|

| Salesforce | Varies based on edition | Extensive integration options | Compliance tools, industry templates |

| HubSpot | Free to start, pricing tiers available | Integration with various marketing tools | Marketing automation, lead management |

| Microsoft Dynamics | Varies based on edition | Seamless integration with Microsoft products | Business application integration, Office 365 integration |

Case Studies of Successful Implementations

Real-world case studies provide valuable insights into how financial service companies have benefited from using Salesforce, HubSpot, or Microsoft Dynamics as their CRM solution:

Company A saw a 20% increase in customer retention after implementing Salesforce’s CRM system, thanks to personalized customer interactions and data-driven insights.

Company B streamlined its lead management process with HubSpot’s CRM, resulting in a 30% increase in qualified leads and a more efficient sales pipeline.

Company C improved collaboration and productivity among its teams by integrating Microsoft Dynamics with Office 365, leading to a 25% increase in overall efficiency.

Customization and Scalability in CRM

Customization and scalability are crucial aspects when it comes to implementing CRM systems in the financial services industry. Let’s delve into why they are important and how they can benefit financial institutions.

Importance of Customization in CRM

Customizing CRM systems to meet the unique needs of financial services is essential for improving efficiency and enhancing customer relationships. By tailoring the CRM to specific requirements such as client data management, compliance tracking, and financial product recommendations, financial institutions can provide a more personalized and targeted service to their clients.

- Custom fields and workflows: Creating custom fields and workflows in CRM software allows financial institutions to capture and analyze data specific to their business processes. This customization enables better decision-making and more accurate reporting.

- Integration with existing systems: Customizing CRM systems to integrate seamlessly with other tools and software used in financial services, such as accounting software or portfolio management tools, can streamline operations and improve overall productivity.

- Scalability for growth: As financial institutions grow and expand their client base, it is essential that CRM systems can scale accordingly. Customized CRM solutions can be easily adapted and expanded to accommodate the increasing needs of the organization.

Best Practices for Tailoring CRM Systems

When tailoring CRM systems for specific financial service requirements, it is important to follow best practices to ensure success and efficiency.

- Define clear objectives: Before customizing CRM systems, financial institutions should clearly define their objectives and goals to ensure that the customization aligns with their business needs.

- Involve stakeholders: It is crucial to involve key stakeholders such as sales teams, customer service representatives, and IT professionals in the customization process to gather insights and feedback for a more comprehensive solution.

- Regularly review and optimize: Customized CRM systems should be regularly reviewed and optimized to ensure they are meeting the evolving needs of the organization and driving positive outcomes.

Integration with Financial Tools and Systems

Integrating CRM with accounting software, banking systems, and financial analytics tools is crucial for enhancing operational efficiency in financial services.

Significance of CRM Integration

Seamless integration with accounting software allows financial professionals to access client financial data directly from the CRM system, eliminating the need for manual data entry and ensuring data accuracy.

Integration with banking systems enables real-time updates on client transactions, balances, and account activities, providing a comprehensive view of the client’s financial status.

Connecting CRM with financial analytics tools allows for in-depth analysis of client portfolios, financial trends, and performance metrics, empowering financial advisors to make data-driven decisions.

Overall, integrating CRM with these financial tools and systems streamlines processes, improves data quality, and enhances client relationships in the financial services industry.

Challenges and Solutions

- Challenge: Compatibility issues between CRM and existing financial infrastructure.

- Solution: Employing middleware solutions or custom integration development to bridge the gap and ensure seamless data flow between systems.

- Challenge: Data security concerns when sharing sensitive financial information between systems.

- Solution: Implementing encryption protocols, access controls, and regular security audits to safeguard client data during integration processes.

- Challenge: Training staff on new integrated systems and processes.

- Solution: Providing comprehensive training programs, user manuals, and ongoing support to ensure smooth adoption and utilization of integrated CRM and financial tools.

Data Management and Compliance in CRM for Financial Services

Data security and compliance are crucial aspects of CRM systems for financial institutions to ensure the protection of sensitive financial information and adherence to regulatory requirements.

Handling Sensitive Financial Data

CRM platforms in financial services employ robust security measures to handle sensitive financial data. Encryption techniques are used to safeguard information during transmission and storage, while access controls restrict unauthorized users from viewing or modifying data.

Ensuring Regulatory Compliance

Financial institutions must adhere to various regulations when managing customer data in CRM systems. Examples include the General Data Protection Regulation (GDPR), the Gramm-Leach-Bliley Act (GLBA), and the Payment Card Industry Data Security Standard (PCI DSS).

Best Practices for Data Integrity

- Regularly conduct audits and assessments to identify vulnerabilities and ensure compliance with data protection laws.

- Implement data encryption and secure access controls to prevent unauthorized access to sensitive information.

- Educate employees on data security protocols and the importance of maintaining client confidentiality.

- Maintain accurate records and monitor data usage to detect any anomalies or suspicious activities.

Role of Encryption and Access Controls

Encryption plays a vital role in safeguarding sensitive financial information within CRM systems by converting data into a coded format that can only be deciphered with the appropriate decryption key. Access controls limit who can view, edit, or delete data, ensuring that only authorized personnel can access confidential information.

Customer Segmentation and Personalization in Financial CRM

Customer segmentation plays a crucial role in tailoring financial services using CRM data. By categorizing customers based on specific criteria such as demographics, behavior, or preferences, financial institutions can create personalized communication and service offerings that better meet the needs of each segment.

Role of Customer Segmentation in Financial CRM

Customer segmentation allows financial institutions to better understand their customers’ needs and preferences. By dividing customers into groups with similar characteristics, institutions can target each segment with tailored marketing messages, products, and services. This leads to more effective communication and higher customer satisfaction.

- Segmenting customers based on life stage (e.g., young professionals, retirees) allows financial institutions to offer targeted products and services that align with their current financial goals and needs.

- Behavioral segmentation, such as spending habits or investment preferences, helps institutions anticipate customer needs and provide relevant recommendations or solutions.

- Demographic segmentation (age, income, location) enables institutions to personalize marketing campaigns and offers to different customer groups, increasing engagement and retention.

Personalized Communication and Service Offerings in CRM

CRM systems enable personalized communication with customers by storing detailed information about their interactions, transactions, and preferences. This data allows institutions to send targeted messages, offers, and recommendations through various channels, fostering stronger relationships and loyalty.

- Personalized emails with relevant content based on customer behavior or interests can increase engagement and conversion rates.

- Customized product recommendations or offers based on past purchases or interactions can enhance the customer experience and drive sales.

- Providing personalized customer service through CRM data analysis can help institutions address individual needs promptly and effectively, leading to higher satisfaction and loyalty.

Successful Customer Segmentation Strategies in Financial Institutions

Financial institutions have implemented various successful customer segmentation strategies to improve their marketing efforts, customer relationships, and overall business performance.

- Banking institutions segment customers based on account activity, financial goals, and risk tolerance to offer personalized investment advice and services.

- Insurance companies categorize customers by age, family status, and coverage needs to provide tailored insurance products and pricing.

- Wealth management firms segment clients by asset size, investment preferences, and risk profile to deliver customized wealth planning and investment strategies.

Automation and Workflow Optimization in Financial CRM

Automation plays a crucial role in streamlining repetitive tasks and processes within financial services, leading to increased efficiency and reduced manual errors. Workflow optimization in CRM systems further enhances productivity and customer satisfaction by ensuring seamless operations and timely responses.

Benefits of Automation in Financial CRM

- Automating repetitive tasks such as data entry, lead nurturing, and follow-up emails saves time and resources while improving accuracy.

- Automated workflows enable faster processing of client requests, leading to quicker responses and enhanced customer satisfaction.

- By automating routine processes, financial institutions can focus on more strategic initiatives and personalized customer interactions.

Comparison between Manual and Automated Data Entry

- Manual data entry is prone to errors and time-consuming, while automated data entry ensures data accuracy and consistency.

- Automated data entry processes can handle large volumes of data efficiently, reducing the risk of human errors and improving data quality.

- Automated data entry also enables real-time updates and synchronization across multiple systems, enhancing data integrity and accessibility.

Setting up Automated Notification System for Client Updates

- Define the triggers for notifications, such as client interactions, account activities, or upcoming deadlines.

- Create personalized notification templates for different types of updates and reminders.

- Configure the CRM system to send notifications via email, SMS, or in-app messages based on predefined rules and preferences.

Integration of AI-Powered Chatbots in Financial CRM

- AI-powered chatbots can handle customer inquiries, provide support, and offer personalized recommendations based on user interactions.

- Chatbots enhance customer service by providing instant responses, 24/7 availability, and seamless integration with CRM systems for data synchronization.

- By automating routine customer interactions, chatbots free up human agents to focus on complex queries and strategic tasks, improving overall efficiency.

Role of Data Analytics in Workflow Optimization

- Data analytics helps identify bottlenecks, inefficiencies, and opportunities for automation within financial CRM systems.

- By analyzing customer data, transaction histories, and engagement patterns, financial institutions can optimize workflows for better resource allocation and process improvement.

- Data-driven insights enable proactive decision-making and continuous improvement in workflow optimization, leading to enhanced operational efficiency and customer experience.

Mobile CRM Solutions for Financial Services

Mobile CRM applications have become essential tools for financial service professionals who are constantly on the go. These applications are designed to enhance accessibility, productivity, and customer interactions, allowing users to stay connected and efficient even outside the office environment.

Importance of Mobile CRM

- Mobile CRM enables financial service professionals to access important client information and updates in real-time, allowing for quick decision-making and responsiveness.

- It improves communication with clients by providing the flexibility to connect anytime, anywhere, leading to enhanced customer satisfaction and loyalty.

- With mobile CRM, professionals can manage tasks, appointments, and follow-ups on the move, increasing productivity and efficiency.

Features of Mobile CRM

- Mobile access to client profiles, account details, and transaction history for quick reference during client meetings or interactions.

- Integration with mapping and navigation tools for efficient route planning and travel optimization for client visits.

- Secure messaging and communication features to maintain confidentiality and compliance with data protection regulations.

- Offline access capabilities to ensure continuous functionality even in areas with limited or no internet connectivity.

Training and Adoption of CRM Systems in Financial Services

Implementing CRM software in financial institutions comes with its own set of challenges, particularly when it comes to training employees to effectively use the system. Without proper training, the full potential of the CRM may not be realized, impacting overall efficiency and ROI.

Challenges of Training Employees in Financial Institutions

- Complexity of CRM systems and features

- Resistance to change from existing processes

- Varying levels of tech-savviness among employees

- Time constraints for training amidst daily tasks

Best Practices for Successful CRM Adoption

- Provide comprehensive initial training sessions for all employees

- Offer ongoing support and resources for continuous learning

- Create role-specific training programs to cater to different user needs

- Incorporate hands-on practice and real-life scenarios in training

Examples of Effective Training Programs

- Simulated training modules with interactive exercises

- Mentorship programs pairing experienced users with beginners

- Regular workshops and webinars on advanced CRM features

Importance of Customizing CRM Training

Customizing CRM training to suit different roles within financial organizations is crucial for ensuring maximum adoption and utilization. Tailored training programs can address specific needs and challenges faced by different departments, leading to better outcomes.

Strategies for Continuous Learning and Skill Development

- Encourage employees to explore new CRM features independently

- Provide refresher courses and advanced training for long-term users

- Incorporate CRM training into performance evaluations and goal-setting

Key Metrics to Track CRM Training Effectiveness

- Percentage of employees completing training modules

- Time taken to achieve proficiency in CRM usage

- Improvement in data accuracy and customer interactions after training

Customer Feedback and Analytics in Financial CRM

Customer feedback and analytics play a crucial role in optimizing financial services through CRM data. By analyzing customer interactions, CRM systems can help financial institutions enhance service quality, boost customer retention, and drive business growth.

Utilizing Customer Feedback for Service Improvement

Customer feedback is a valuable source of information for financial institutions. By collecting and analyzing feedback through CRM systems, organizations can identify areas for service improvement, address customer pain points, and enhance overall customer satisfaction. For example, if customers consistently provide feedback about long wait times on the phone, a financial institution can use this data to streamline their customer service processes and reduce wait times.

Analyzing Customer Interactions for Insights

CRM analytics allow financial institutions to gain valuable insights from customer interactions. By tracking customer behavior, preferences, and engagement patterns, organizations can tailor their services to meet individual customer needs and preferences. For instance, analyzing customer data may reveal that a particular group of customers prefers online banking over traditional in-person transactions. This insight can help financial institutions focus their efforts on improving their online banking services to better cater to this demographic.

Actionable Insights from CRM Analytics

CRM analytics provide financial institutions with actionable insights that can drive strategic decision-making. For example, by analyzing customer data, a bank may discover that a significant number of customers in a specific demographic have been showing increased interest in investment products. Armed with this information, the bank can create targeted marketing campaigns to promote its investment offerings to this demographic, ultimately increasing sales and revenue.

Future Trends in CRM for Financial Services

The financial services industry is continuously evolving, and so is the role of Customer Relationship Management (CRM) systems within it. Let’s explore some of the key trends shaping the future of CRM for financial services.

Emerging Technologies in CRM

As technology advances, so do the capabilities of CRM systems. Emerging technologies like Artificial Intelligence (AI), blockchain, and predictive analytics are playing a significant role in transforming CRM for financial services.

- AI-powered chatbots are revolutionizing customer interactions by providing instant support and personalized assistance.

- Blockchain technology is enhancing data security and transparency, ensuring trust in financial transactions.

- Predictive analytics is helping financial institutions anticipate customer needs and preferences, enabling proactive and personalized service.

Data Security and Privacy Regulations

With the increasing focus on data security and privacy, CRM systems in the financial sector need to comply with stringent regulations. The implementation of CRM systems must ensure the protection of sensitive customer information and adherence to data privacy laws.

Machine Learning for Customer Segmentation

Machine learning algorithms are being increasingly used to optimize customer segmentation and marketing strategies within CRM frameworks. By analyzing customer data and behavior patterns, machine learning algorithms can help financial institutions target the right audience with personalized offerings and messages.

Case Studies and Success Stories of CRM Implementation in Financial Services

In the realm of financial services, the successful implementation of CRM systems can make a significant impact on operational efficiency, customer satisfaction, and overall business growth. Let’s delve into some real-life examples of financial institutions that have reaped the benefits of CRM adoption.

Example 1: Bank XYZ

- Bank XYZ faced challenges in managing client data effectively and providing personalized services.

- By implementing a robust CRM system, they streamlined their customer interactions and improved data management.

- Outcome: Bank XYZ reported a 20% increase in customer satisfaction and a 15% growth in cross-selling opportunities.

Example 2: Investment Firm ABC

- Investment Firm ABC struggled with manual processes and siloed data across departments.

- After integrating a comprehensive CRM solution, they achieved seamless data flow and enhanced collaboration among teams.

- Outcome: Investment Firm ABC saw a 30% reduction in lead response time and a 25% increase in client retention rates.

Comparison Chart of CRM Systems for Financial Services

| CRM System | Key Features | Benefits |

|---|---|---|

| CRM System A |

|

|

| CRM System B |

|

|

Final Conclusion

Choosing the best CRM for financial services is a strategic decision that can propel your business to new heights. By prioritizing customer relationships, data management, and compliance, you can ensure long-term success in the competitive financial industry.